This week will bring high impact data considering that the minutes of the FOMC and the data of the production of services of the Institute Supply Management will be available.

This week will bring high impact data considering that the minutes of the FOMC and the data of the production of services of the Institute Supply Management will be available.

The most relevant data will be the meeting scheduled for the economic policy guidelines. They are likely to provide more information and clarity on projections of interest rate changes.

The current economic guidelines have generated some concerns and debates among FED officials about an overheating of the economy, generating many expectations about the future of the economy.

It is questioned that, given the rate of economic growth that is taking place in the US, why maintain stimuli that were implemented to alleviate the effects of the 2020 crisis.

For this reason, announcements about gradual changes to be implemented are expected. An announcement of this nature may generate movements in the markets but will also provide clarity as to what the next steps will be and what indicators we should be vigilant about.

Among the changes that are expected in the short term, is the decision on the policy for the purchase of assets that, by the end of the year, will probably announce a beginning of the reduction in the rate.

On Tuesday they published the evolution of the service industry for the last month by the Institute Supply Management. As expected, the pace of expansion was maintained but, like manufacturing production, with a slight slowdown in pace. The expansion rate in the services sector remains strong despite the decline to 60.1 from the historical maximum of the previous month. Challenges in the face of material shortages, inflation, logistics and labor resources remain.

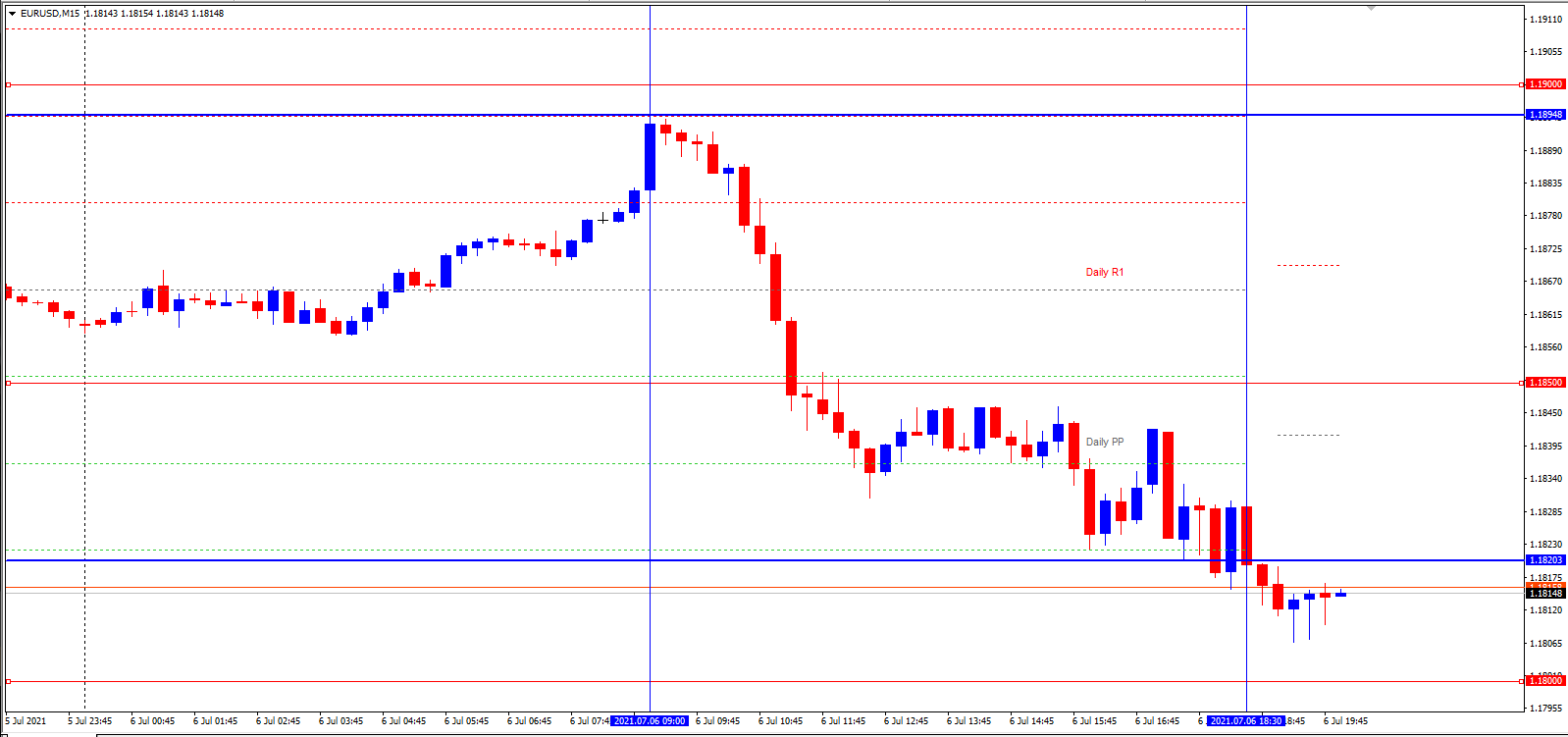

The EURUSD closed the day for sell at 1.18203 after opening at 1.18948.

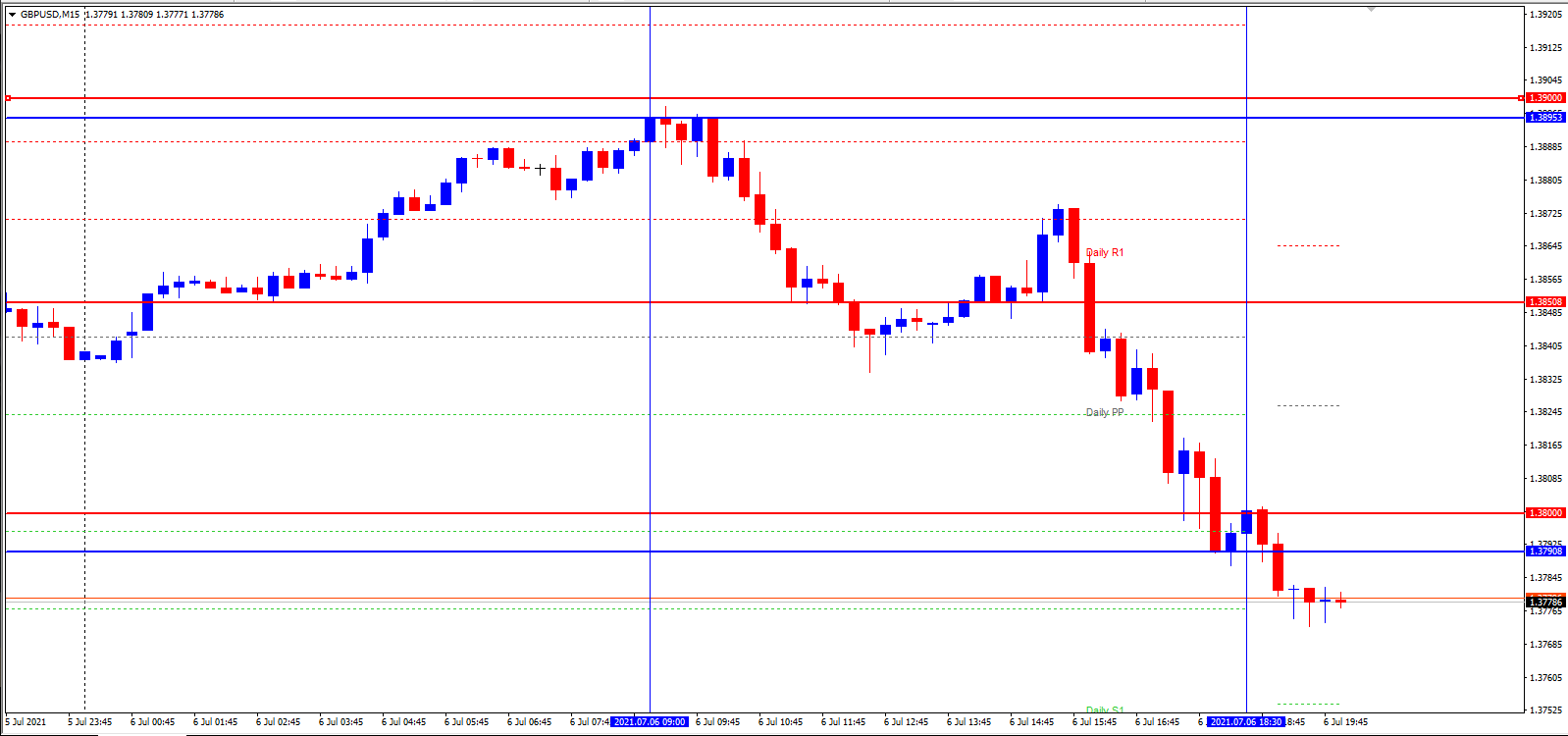

GBPUSD closed for sell after similar behavior, opening at 1.38953 and closing at 1.37908.

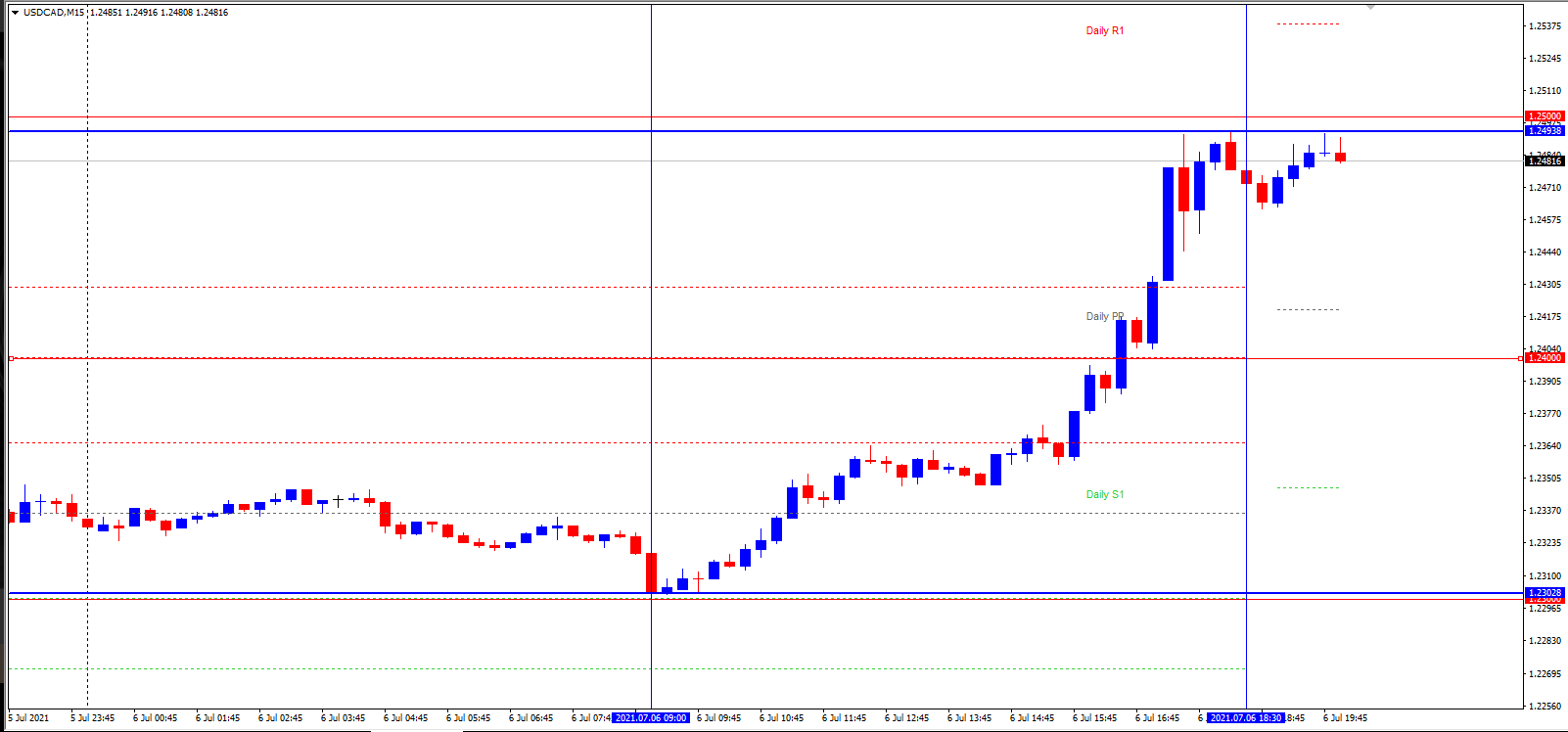

USDCAD opened Tuesday at 1.23028 and closed buy at 1.24938.

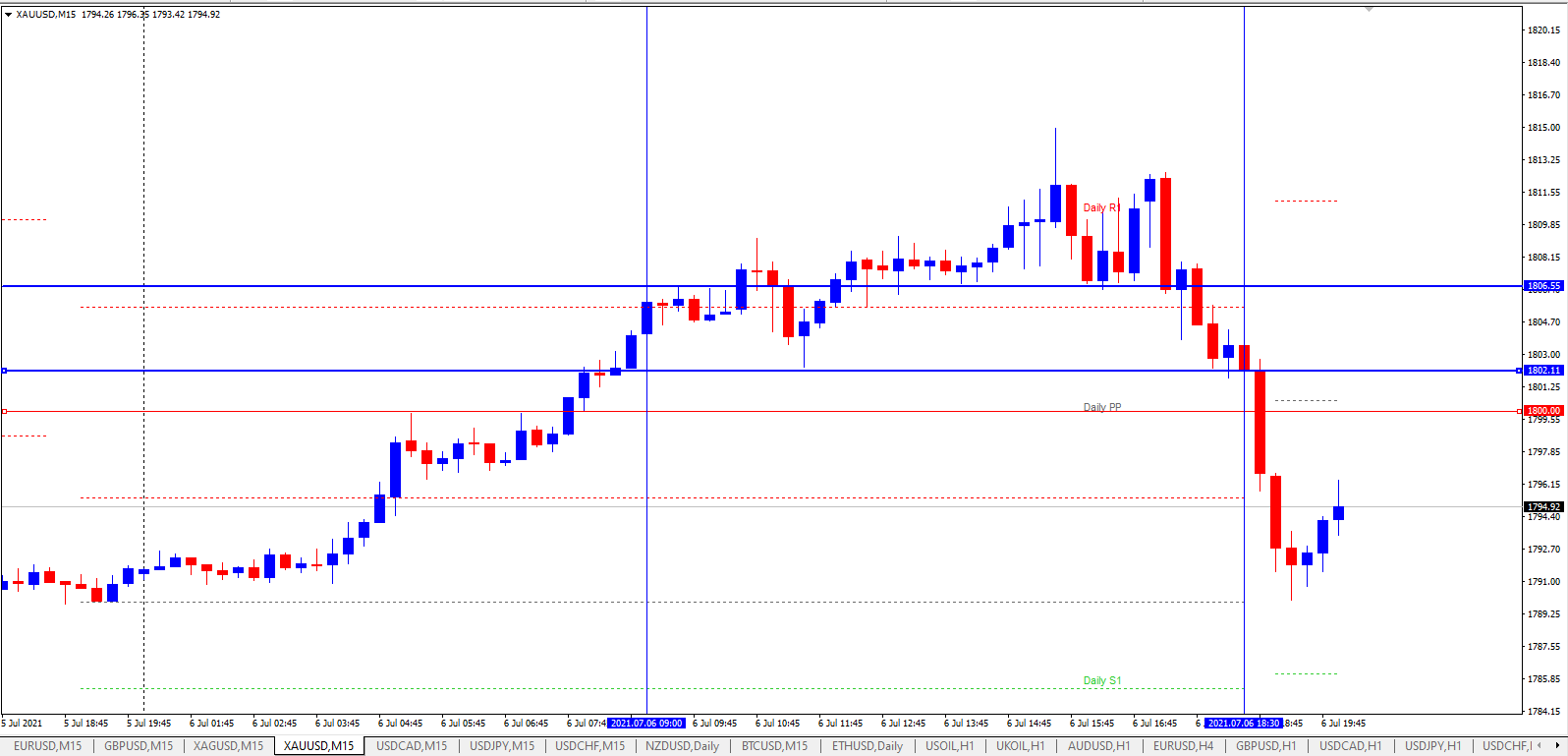

The GOLD, opened on Wednesday at 1806.55 and closed for sell at 1802.11

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.