This Wednesday the PMI data for countries such as Germany and the United States will be released. Both economies will receive preliminary data for the indicator in manufacturing and services.

This Wednesday the PMI data for countries such as Germany and the United States will be released. Both economies will receive preliminary data for the indicator in manufacturing and services.

Higher than projected results are always positive for the currency. For the current projection, positive and elevated results are expected to remain, however, with a slight setback. Germany’s manufacturing PMI is expected to be 63.0, while the latest measurement was 64.4. As for the services PMI, with the total lifting of restrictions, the result is expected to be 55.8, last 52.8 is expected 55.8

This Tuesday the European Commission approved the stimulus plan for the German economy with a subsidy plan until 2026. The ministerial approval of finance is still pending next month.

The plan consists of $ 25.6 billion euros to implement in order to recover from the crisis and invest in the economy to transform it to be more ecological and digitized, that is, to start a process of “digitization and decarbonization”. Germany seeks to diversify the energy matrix and make it more efficient towards renewable and sustainable energies. In relation to services, it is aimed at public health and business services.

The US data comes after the announcement by the Federal Reserve that they began with the reduction of the stimulus and changes in the interest rate towards 2023. On the eve of Powell’s statements before Congress, opinions on the actions to withdraw the crisis recovery measures are diverse. The president of the Cleveland Fed, Loretta Mester, said Tuesday that monetary policy must consider the risks to financial stability, ultra-low interest rates.

The truth is that the reactivation of economic activity, vaccination plans and the reduction of restrictions, led to positive economic results for the latest measurements.

The US manufacturing PMI projects that production and economic activity remain stable with a slight drop towards 61.5. While the service sector projects a similar behavior, resulting in around 70.0.

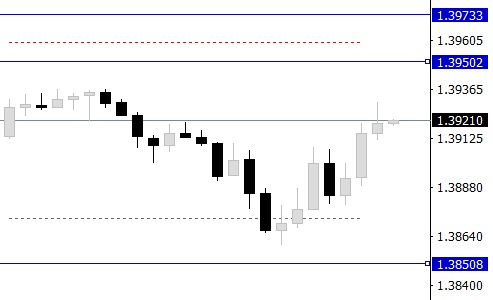

Both the EURUSD and GBPUSD cross remain in buy preference.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.