Crude futures posted losses this Wednesday after the decision made between the countries that make up OPEC +. BRENT and WTI posted losses of almost 2%.

Crude futures posted losses this Wednesday after the decision made between the countries that make up OPEC +. BRENT and WTI posted losses of almost 2%.

Crude prices have been affected in recent hours by three factors.

On the one hand, the Organization of the Petroleum Exporting Countries and allies, decided to increase oil production. The increase will be for a planned monthly production of 400,000 barrels per day.

The agency estimates that global inventories continue on the path of reduction for the remainder of the year. OPEC + is working on the gradual restoration of the oil supply. This supply was greatly reduced by the pandemic and the ravages of 2020.

On the other hand, the concerns of the recovery and the sustainability of the demand are increasingly visible with the increases in the spread of the Delta variant.

Third, crude inventories in the United States showed a greater drop than expected. Last week’s report was presented by the Energy Information Administration and indicated that the reduction was -7169M barrels compared to the -3088M expected.

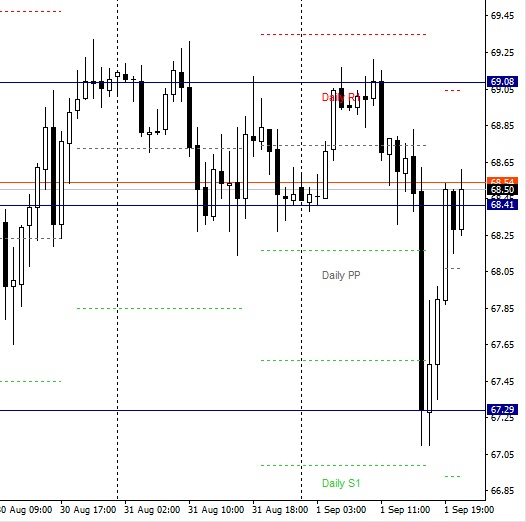

These factors caused a shock effect on the prices of BRENT and WTI, where immediately the price fell to $ 70.58 dbp and $ 67.28 dbp respectively and then achieved a partial recovery.

Both the BRENT and the WTI closed their day sold. The BRENT is currently trading at $ 71.43 dbp and the WTI at $ 68.37.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.