This Tuesday the oil market registered pressures, after the fall in its prices. What is affecting prices are the pressures on demand and the energy crisis that is taking place in both Europe and China.

This Tuesday the oil market registered pressures, after the fall in its prices. What is affecting prices are the pressures on demand and the energy crisis that is taking place in both Europe and China.

In Europe, prices reached a new record for gas, energy and carbon prices. The concerns revolve around the beginning of the period of greatest demand, where supply and increasing demand are reflected in prices.

Post-crisis COVID-19 circulation flexibilities lead to a generalized growth in demand, where the opposite effect occurred since March 2020 when world demand plummeted.

In the American continent, the problematic situation around production develops after Hurricanes Ida and Nicholas, which affected the US Gulf of Mexico in the last two months. The passage of the hurricanes damaged platforms, pipeline and processing centers, affecting most of the offshore production for weeks.

Expectations are now based on data to be released this afternoon by the American Petroleum Institute (API) on crude inventories in the country.

In this context, the energy crisis unfolding in China is added, which puts global supply chains on edge and projects an increase in Chinese imports.

According to OPEC, demand for oil will grow dramatically in the coming years as economies recover from the pandemic.

BRENT reached a nearly three-year high of $ 79.83. It closed its operations for sale at $ 78.3 dollars a barrel of oil.

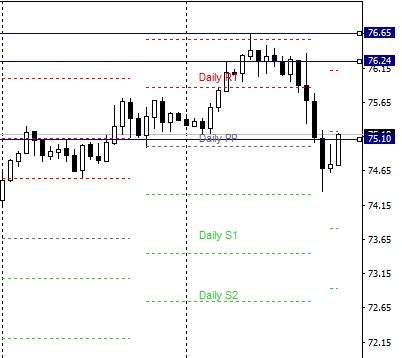

The WTI also reached highs of $ 76.65 a barrel of oil. The closing of its operations is for sale at $ 75.1.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.