The dollar recovered all of its losses for the week at the close of Friday. The good American employment data for July made clear the recovery of the economy. This information generated a jump in the probabilities of the rise of the changes of the FED. American inflation data this week is expected to generate the correction from Friday’s buyers. Expectations are growing this week that the Fed could be close to political changes earlier than expected.

This second week of August will be defined by the impact of inflation on the economy.

Market projections August 09 to 13.

Access all available Price Action for All lessons here.

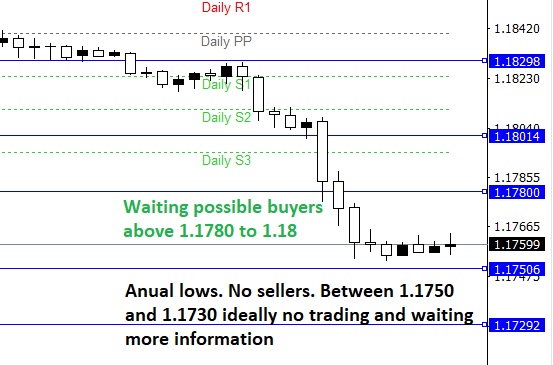

EURUSD prefers to wait for buyers in the area. Avoid sell between 1.1750 and 1.1730. Buys from 1.1790 only.

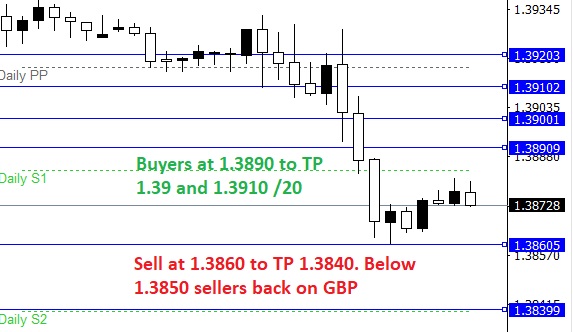

GBPUSD Buyer preference over 1.3890 to 1.39 and 1.3910. Sells below 1.3860 to 1.3840.

AUDUSD sell preference below 0.7350 at TP 0.7330 and 0.7320. Buys from 0.7360 to TP 0.7370.

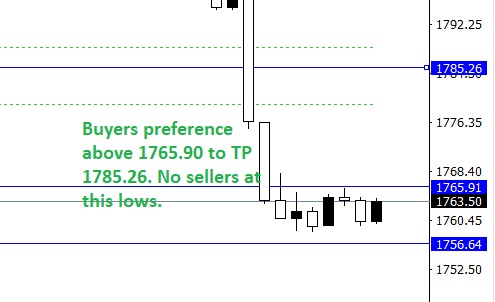

XAUUSD buy preference over the lows of 1765.90 and 1756.64. Sells are not suitable above these area minima.

XAGUSD sell preference below 24.30 to 24.08. Caution with sell stop if the buyer falls back above 24.40 cancel the sell and wait for buys above 24.50.

USDCAD sell preference below 1.2540 to 1.2530 and 1.2520. Buys starting from 1.2560 to TP 1.2570.

USDCHF sell preference below 0.9150 up to 0.9140 and 0.9130. Buys above 0.9160 through 0.9170 and 0.9190.

USDJPY sell preference below highs of 110.30 and 110.40. until 110.08. Below 110.0 sell pressure up to 109.90. There are no buys in these intervals.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.