Tomorrow the policy meeting of the Federal Reserve of the United States will end. Markets brace for the impact of the ads. The question is – and continues to be – when and how they will begin to reduce the stimuli implemented to mitigate the effects of the crisis.

A sharp and anticipated reduction could lead to a brake on economic growth, while maintaining them will also affect the real growth of the economy.

The positive economic results of the last measurements, generated expectations about the beginning of the tightening of the policy, but that could slow down due to the results of low GDP growth.

However, the implementation of the reduction of stimuli will happen, the fact is when it will determine the FED will begin with changes in the interest rate and reductions in the purchase of assets.

The interest rate is expected to remain at 0.25%, unchanged from previous months.

The increase in inflation is still considered temporary, therefore the 0.9% increase announced two weeks ago does not yet generate great expectations of change.

EURUSD closed buy, after opening below 1.1782 and hitting 1.18244.

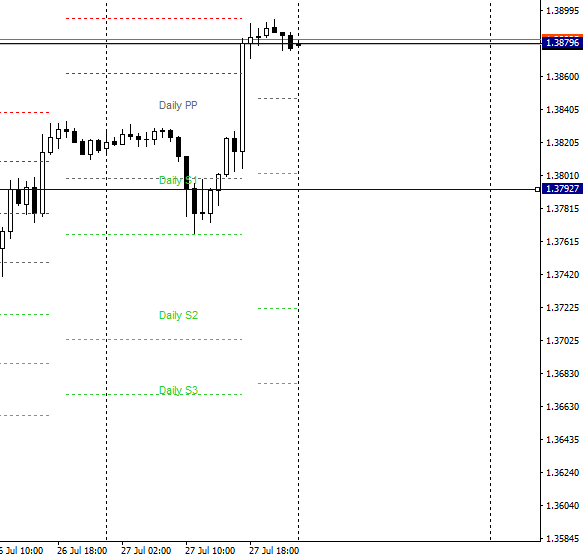

As for the GBPUSD, it opened at 1.3792 and also closed buy at 1.3879.

Leave a Reply

You must be logged in to post a comment.