Officials at the European Central Bank are set to reveal their new monetary strategy this Thursday. These decisions are expected to really make a difference for the direction of the euro and for investors. Policymakers will modify their stance to reflect changes ranging from a slightly higher inflation target of 2% to an explicit assignment that they could exceed it for a time. ECB President Christine Lagarde has already prepared the financial markets, saying that they should prepare for a new orientation on stimulus «given the persistence we must demonstrate to meet our commitment.»

Market projections in opening from Monday, July 19 to 23

EURUSD closed above its area lows. This Thursday we will know the new guidelines of the ECB. Major changes are expected in the market. Euro preference is buy over the lows of 1.18 and 1.1770.

GBPUSD closed sell. Sell preference only below 1.3730. Between the lows of the 1.3760 and 1.3750 area, we must await more information for possible new buyers at lows.

USDCAD closed buy. Above 1.26 the buy market holds its positions. Below 1.26 possibility of sell. Crossing in the buy zone currently. Expiration sells.

USDJPY closes in transition. Buy preference over 110.0. Sell preference only from 109.90.

USDCHF closed buy. Sell preference below area highs from 0.9180. Buys above 0.92.

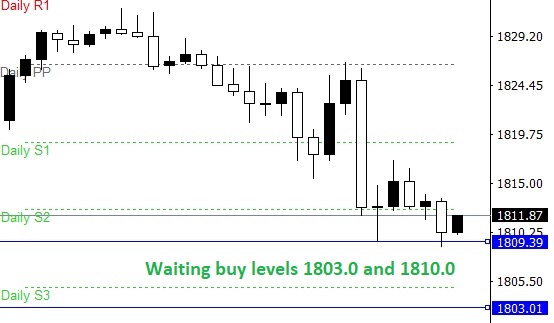

GOLD. Closes above 1800.0. Buy preference between 1803.0 and 1810.0 Expect lower buyer prices at Friday’s close. Silver will follow in the footsteps of gold, we expect buys between 25.80 and 25.90. Buy preference.

AUDUSD closed sell. It is kept in the sell area. Below 0.74 we expect it to complete the range to 0.7350 and 0.7330.

BTCUSD buy preference over 32,000 to 32,400 with extension to 32,800. If the correction continues in the week we will have buy levels at 31,500 and 31,200.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.