The dollar closed lower this week and buyers would be expected at Monday’s open. US employment data is estimated positive for this week. The highlight of the symposium were remarks by Jerome Powell who said that asset purchases could begin to slow down this year as the US economy recovers from the pandemic, but that he will be in no rush to raise interest rates. . Powell took a note of caution on employment levels, sticking to the central bank’s message that the current outbreak of inflation is partly due to supply chain disruptions caused by Covid-19 and is likely to be transitory.

Powell did not provide a specific timeline to begin reducing the Fed’s $ 120 billion per month on bond purchases, a program that began last year in response to the Covid-19 crisis. While the economy is on a solid path forward, the Fed will carefully assess incoming data to see how risks like the delta variant of the virus could affect progress toward its targets, Powell said. The markets took the speech in stride. US stocks advanced to another record, while yields on Treasuries and the dollar fell.

Powell’s comments were echoed by his number two, Vice President Richard Clarida, even as the toughest wing of the central bank urged the need to start the downsizing process as soon as possible.

GBPUSD market sustains buyers above 1.3750 to the highs of 1.3780. Below 1.39 we have area highs. Caution in the buy transition zone. Below 1.3750 we sell up to 1.3730 and 1.3720.

EURUSD below the highs of 1.18 and 1.1820 we prefer to wait for sellers. Below 1.1790 we sell. Buy is still high risk between 1.18 and 1.1830.

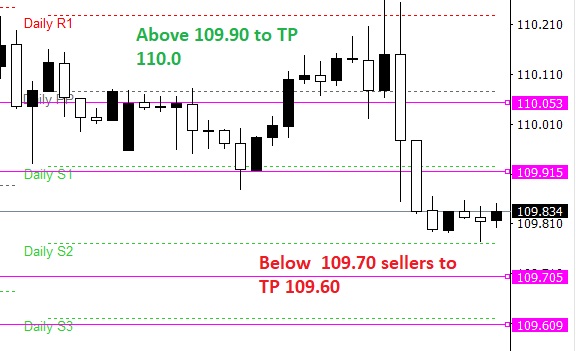

USDJPY sell preference from 109.70 to 109.60. Buys are for about 109.90 up to 110.0 and 110.20.

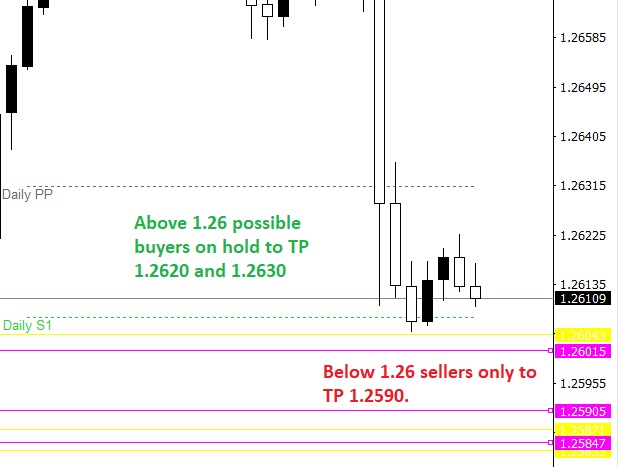

USDCAD sells below 1.26 to 1.2590. Above 1.26 the market remains in the buyer area until 1.2620 and 1.2630. Buy preference.

XAUUSD remains buy above 1820.0 and next level 1830.0. Buys remain.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.