A stable market opening is expected given the activity of the central banks for this Wednesday and Thursday. Canada’s government elections will have a possible impact on the Canadian dollar. Volatility would be expected during Monday due to results. On Wednesday 3:00 pm EST we await the result of the FOMC review: announcements of cuts in bond purchases are estimated unchanged from the previous month.

On Thursday 8:00 am EST, the Bank of England would also announce its interest rate decision, it could begin to consider that the minimum criteria for a tighter monetary policy have been met. The BOE had previously said that it would hold the policy on hold at least until those conditions are met. Governor Andrew Bailey revealed that the Monetary Policy Committee was split 4-4 at its August meeting on whether there was clear evidence that the economy is eliminating spare capacity and meeting the 2% inflation target in a «sustainable» manner.

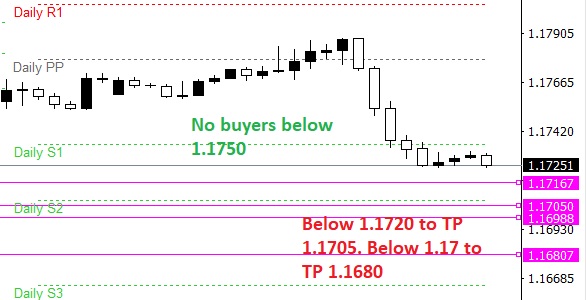

EURUSD sell preference. Below 1.1720 through 1.1705. Below 1.17 through 1.1680.

GBPUSD sell preference. Below 1.3730 to 1.3720. Below 1.3720 to 1.37.

AUDUSD sell preference. Below 0.7260 to 0.7250. Passing 0.7250 to 0.7240 and 0.7230.

GOLD buy preference over lows of 1750.0 and 1743.0. Levels waiting next week are 1777.0 and 1793.0

USDCAD buy preference. About 1.3770 to 1.28. Going 1.28 to 1.2830. Caution between the highs of 1.28 and 1.2830.

BTCUSD institutional buys are held above 45,000. Between the lows of 45,000 and 46,000 the market manages to sustain itself. It is advisable to enter about 48,000 next week.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.