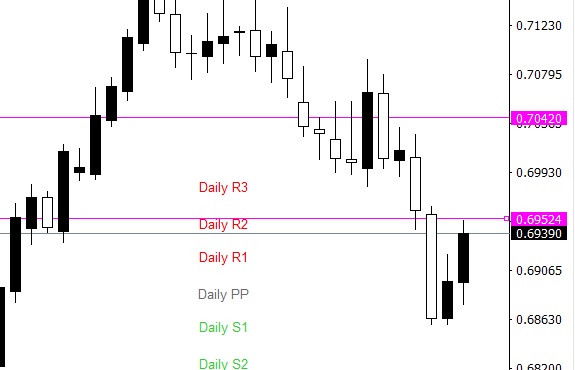

Already entered the last momentum of 2021 but in retreat. This week Australia and New Zealand will review their interest rates. New Zealand is forecast once again to raise its interest rates. In the previous month the forecast was failed and now we will see what happens this Tuesday. The higher NZDUSD price is one step from positioning to enter the 0.70 range. This decision on Wednesday could give the final touch that the crossing needs to get a buy position. Above 0.6950, the crossing reaches the minimum necessary to hold up to 0.70 and 0.7050. If the forecast fails again the market would prepare to take profit and we will have a downward crossing to 0.6870.

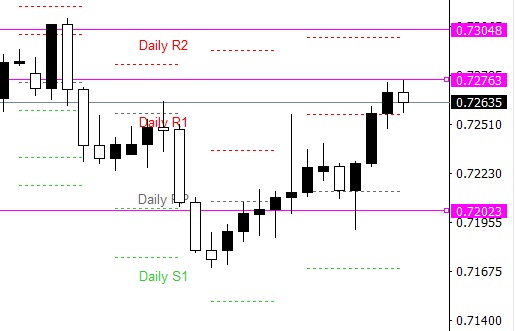

Australia would review its interest rates, remaining at 0.10%. The Australian failed to position himself above 0.73 for the entire month of September. Buyers would lose motivation this Tuesday and take profit leaving the AUDUSD cross below 0.7250 and 0.72. Despite the announcements by the RBA about raising interest rates for the next 2022 and 2023, the market reacted pessimistically. Economists remain skeptical of the possible rise next year.

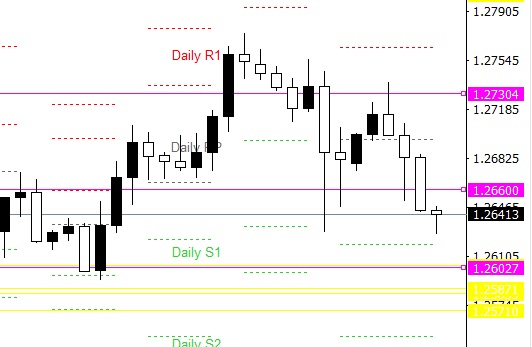

The American employment data will be the determining factors in the direction the market will take for October. Beginning Wednesday at 9:15 am EST, a preview of the variation of new American jobs created is presented. The forecast is positive but its result will not define the dollar. Positive forecasts for the US are expected on Friday, both unemployment and new job creation are expected with good advances as a result of the month of September. If any of the data does not meet market expectations, it is possible that we will witness an impact in both directions for the dollar. Let’s not forget that Canada will update us with the national employment situation that same day as well. USDCAD remains at levels above 1.26 with high buyer potential. However, if Canada’s recovery surpasses that of the United States, this crossing will pass to the 1.25 levels. Otherwise, we will have the strength of the dollar again until 1.27 and 1.2730.

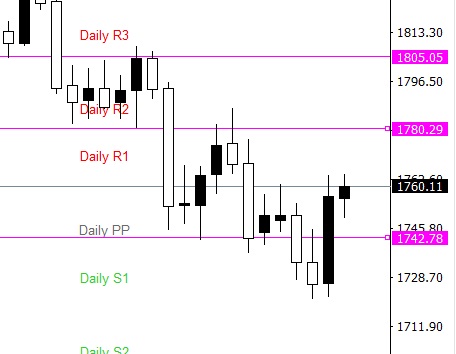

Metal commodities did not suffer significant variations at the end of September. Gold did not stay bought above 1800.0 and last week it returned to the lows. Possibly October repeats the behavior of September. Take profit levels remain between 1786.0, 1800.0, 1820.0, and 1830.0. Buy days that exceed these prices will slope to the next take profit level. Only a change at a fundamental level could change the gold market zone. At the moment the Fed’s interest rate revision did not motivate the buyers of gold or silver.

Leave a Reply

You must be logged in to post a comment.