The week will continue with fears of an Evergrande collapse that could cause financial contagion and slow the growth of the Chinese economy. That concern eased after the developer agreed to settle some local note interest payments, but the problem is far from over with holders of dollar bonds that have yet to receive a coupon due.

The international market showed recovery in the last week despite the rumors. The US30 remains above 34,800 and could return to 35,000 within the next week. SP500 hovers above 4460.0 recovered from 4300.0, could also be on track to 4500.0. Commodities are kept in sell areas without being able to pass strategic prices to buyers. Gold remains below 1800.0 an ounce. This level allows the buyer to maintain their positions from 1720.0 and 1730. However, the take-profit levels between 1760.0 and 1780.0 prevent thinking in the long term. Once the 1800.0 is exceeded, we can maintain long-term in gold estimating the 1850.0 and 1880.0.

Below 1800.0 long-term gold is not recommended, but rather to respect take-profit levels. In the case of silver, 24.0 and 24.50 remained as highs without going to 25.0. Between 22.0 and 22.50 we have the opportunities of buyer positioning. These prices will stay down for a few days. Passing 23.0 we can increase market risk and sustain buys until 24.00. We then move on to analyzing the highs of 24.0 and 24.50 again for possible new buys or taking profit.

USDJPY has taken the market’s attention this week. With a constant recovery above the 110.0 levels. Buyers have remained positioned past the take-profit levels of 110.50 to 110.80. Market uncertainty may push 110.80 through and we have 111.0 and 111.10 for next week. Otherwise we will evaluate sells from 110.50. For euro and pound it will be a week of total definition. Central banks without exchange policies keep these currencies on the verge of moving to their selling areas.

The positioning of the dollar is not repeated in all crosses. USDCAD and USDCHF do not maintain buy levels for the coming week, on the contrary: profits are being taken. In USDCAD the market started to take profit from 1.29. We expect to be below 1.2650 to join the sellers down to 1.26 and 1.25. In the case of USDCHF, we are also going for sells of up to 0.92 and 0.9190.

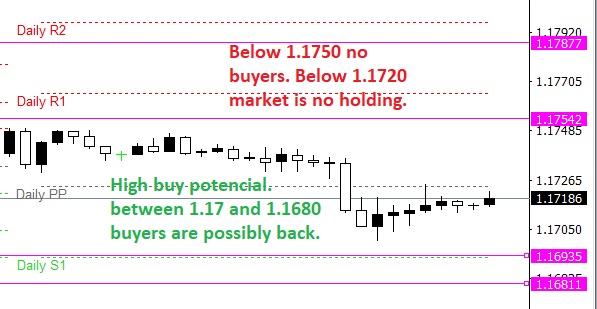

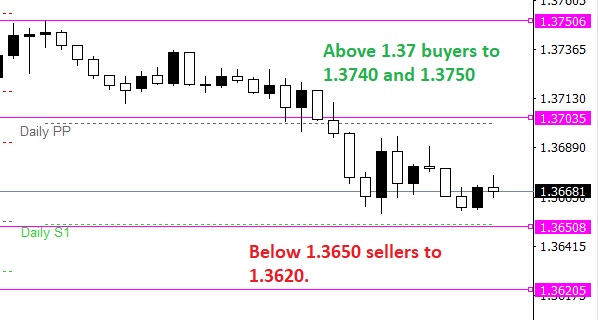

At the moment EURUSD remains unchanged at its buy levels of 1.17. The long-term buyer is not at these prices. Therefore intraday buys are recommended only. Once 1.18 and 1.1820 have been exceeded, we would consider holding positions as targets up to 1.1850 and possible 1.19. Pound manages to stay in its buying market zone. Buys from this market area are not yet important to the long-term buyer. We recommend waiting above 1.3750 to stay in the market with this currency. At the moment the strategy remains intraday with highs at 1.37, 1.3710 and 1.3730.

Market projections for week 27 to 01 of OCT

EURUSD buy preference over 1.1720. Hopefully we have the minimum necessary to buy. These levels do not yet have the necessary positioning.

GBPUSD above 1.37 buyers return. Below 1.3650 possible sell up to 1.3620.

USDCAD below 1.2650 sells up to 1.2630 and 1.2610. Possible buyers over 1.2670 to 1.2690.

USDJPY over 110.80 new buyers through 111.0 and 111.10. Sell below 110.50.

BTCUSD over 43,000 stays buy up to 43,600 and 44,000.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.