This week oil prices have been boosted, returning to highs after almost two weeks of decline. However, since Wednesday, there have been losses in the price caused by two factors.

This week oil prices have been boosted, returning to highs after almost two weeks of decline. However, since Wednesday, there have been losses in the price caused by two factors.

On the one hand, there are concerns about the increase in COVID infections and the new variant throughout the world. These effects on the price, merge with the concerns of the demand. The US Energy Information Administration (EIA) reported that US crude inventories fell in the last week for the third time in a row. The demand for crude oil would have reached levels prior to the pandemic.

However, the advancement of the new Delta variant in the US, overshadows these facts.

The Organization of the Petroleum Exporting Countries will meet next week. On September 1 they have a date to debate and decide their policy, crossed by the US declarations to enable a greater supply and accompany the recovery in the world.

In this context, it is added that the Mexican oil supply fell by more than 400,000 barrels of oil per day due to a fire. This pushed to take the situation for short sellers. The situation will normalize in the next few hours.

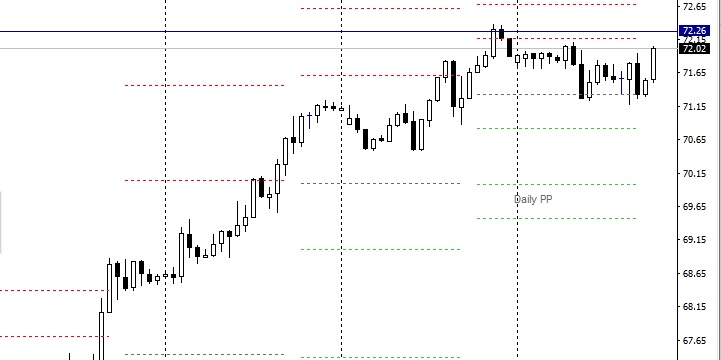

Brent is trading at $ 72.03 a barrel of oil. Closed the day sell.

The WTI closed sell, at $ 68.21 a barrel of oil.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.