This Wednesday the Bank of Canada will meet and publish its decision regarding the interest rate. After it, they will make a statement to inform that it led to said decision.

This Wednesday the Bank of Canada will meet and publish its decision regarding the interest rate. After it, they will make a statement to inform that it led to said decision.

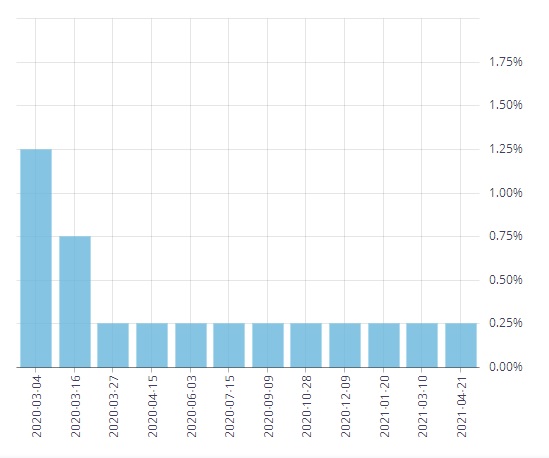

The decision is projected to be to maintain the same monetary policy to maintain the interest rate at 0.25%. Expectations are located in the statements regarding a possible change in the asset purchase policy.

The measure, taken based on economic indicators such as inflationary rates, employment rate and economic growth, probably has some stability because these indicators are so. Even in terms of employment, the latest results were not as expected.

The context is favored by a vaccination policy that has advanced at great speed, proving the possibility of removing the restrictions in force due to the circulation of the virus. Given this, the pace of economic recovery is projected to expand. As the economy advances and is reflected in the economic indicators, in accordance with the objectives of the Bank of Canada, the interest rate is likely to change.

However, these changes will probably not be in the short term and will take place in a staggered manner starting next year, to the same extent that economic growth is reflected.

In this way, the Bank projects a real GDP growth of around 6% for the current year, while for 2022 and 2023, it will be between 3%.

Therefore, the interest rate could be expected to change from 0.25% to 1.25% as prior to the pandemic, in the next two years.

Source: Bank of Canada

In the previous meeting in April, the BoC showed a change in its policy more aggressive than expected. They implemented a change in the asset purchase policy, making the decision to slow down the purchase rate. Another reason that adds to a low expectation of big changes. However, a change in rates would be a positive change for USDCAD

USDCAD closed its bought intraday trading, at 1.20957. As a result of the April decisions, in May the USDCAD assumed a correction reaching lows of 1.20118. Attention in purchases, preference above 1.21.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.