A few days after the central bank interest rate rally, the market is waiting expectantly for inflation data. The message from the financial centers of the world has continued to dovish in general terms. The common message has been: «gradual reduction», «gradually lower purchase rate», «gradual tapering», «we will not get ahead», «until we reach the inflation targets between 2% and 3%». Inflation data from the US and Canada next week will be key for the market.

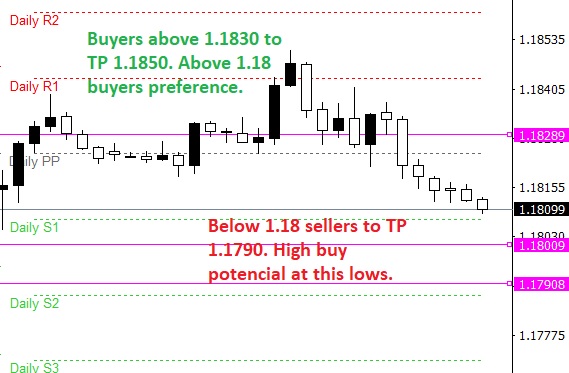

EURUSD remains bullish buy preference above 1.18. We will add buys over 1.1830 only. Below 1.18 we go to sell up to 1.1790.

GPBUSD buy preference over 1.3850. Below 1.3850 we go to sell up to 1.3830 and 1.3820. If tomorrow’s opening brings us up to 1.3860 we will go to buy up to 1.3880 and 1.3890.

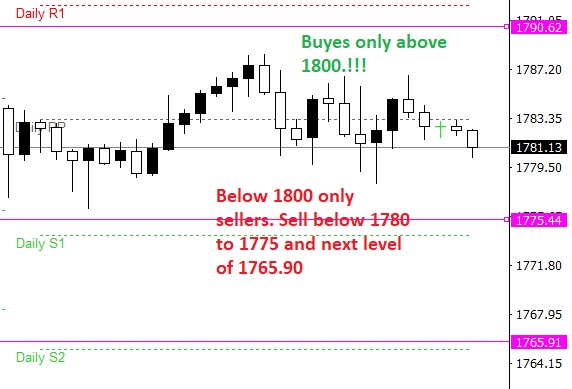

GOLD. Buy preference. The market does not hold over 1800. Buy levels at 1790.0 to 1800. Over 1800 we need confirmation to go to buy.

BTC holds on institutional buy prices. Ideally we will add buys over 46,000 to exit at 47,200.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.