This first week of September comes with a monetary policy combo. This week the publication of Australian interest rates is expected with a maintenance forecast. The aussie could give its correction and possible sales are expected for this Tuesday 1:30 am EST. Canada (BOC) would publish its rate decision on Wednesday 11:00 EST, forecast of maintenance of rates with possible impulses for the Canadian. That same day the Central Bank of England (ECB) will review its monetary policy, giving a possible correction for the pound. Thursday is the turn of the European Central Bank, with possible adjustments to its bond purchase reduction plan. The opinion of European economists does not seem to support this adjustment considered as a «big mistake»… said Paolo Gentiloni, Commissioner for the economy of the European Union, in an interview with Bloomberg Television.

Euro area consumer prices rose at an annual rate of 3% in August, the most in a decade and more than the ECB’s 2% medium-term target. Most of the suggested recommendations that accelerating price increases are due to bottlenecks in the supply chain, according to Stournaras, who heads Greece’s central bank.

Market projections week 06 to 10 of SEP.

EURUSD below 1.19 and 1.1920 we have the highs of the area. We wait for sellers, Thursday’s announcements will keep the euro in consolidation. We buy about 1.1920 to 1.1947 and a possible extension of 1.1977.

GPBUSD above 1.3850 remains in buy preference. We keep buy up to 1.3877 and 1.3890 with possible testing of 1.39. We sell below 1.3847 through 1.3830 and 1.3820.

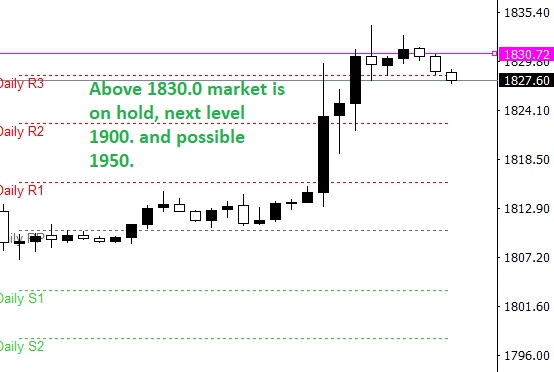

GOLD remains in buy preference. Next level 1850. and 1900. If the opening on Monday manages to keep the commodity below 1820.0 possible take profit up to 1800.0.

USDPY buy preference. Above 109.50 we will wait for buys until 109.90. At 100.0 we return with buy strategies.

BTCUSD remains buy above 51,000, we expect to exit at 52,000.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.